Financial Services Guide

Version: 1 Part: 1

Date: 5 July 2024

Purpose of this FSG

This Financial Services Guide (FSG) and its distribution is authorised by Finchley & Kent Pty Ltd (“Finchley & Kent”).

You have the right to ask us about our charges, the type of advice we will provide you, and what you can do if you have a complaint about our services.

This FSG is intended to inform you of certain basic matters relating to our relationship, prior to us providing you with a financial service. The matters covered by the FSG include, who we are, how we can be contacted, what services we are authorised to provide to you, how we (and any other relevant parties) are remunerated, details of any potential conflicts of interest, and details of our internal and external dispute resolution procedures, along with how you can access them.

It is intended that this FSG should assist you in determining whether to use any of the services described in this document.

It is Part One of our FSG and it must be read in conjunction with Part Two. Please retain both Part One and Part Two for your reference and any future dealings with Finchley & Kent.

Lack of Independence

Under the Corporations Act, we are prevented from using the terms independent, impartial and unbiased as we received commissions for the advice that we provide on life insurance products.

Who will be providing the financial services to me?

Finchley & Kent conducts business through a network of financial Advisers who are appointed as Authorised Representatives under Finchley & Kent’s AFSL.

Where Finchley & Kent has appointed a corporate entity as an Authorised Representative, representatives of that company who give advice will also be authorised by Finchley & Kent.

| Licensee | Finchley & Kent Pty Ltd (“Finchley & Kent”) |

| AFSL Number | 555169 |

| ABN | 50 673 291 079 |

| Business Address | Level 63, 25 Martin Place Sydney NSW 2000 |

| Phone | 1300 770 996 |

| info@finchleyandkent.com.au | |

| Website | finchleyandkent.com.au |

What kinds of financial services are you authorised to provide me and what kinds of products do those services relate to?

Finchley & Kent is licensed to provide advice on, and deal in, the following financial products:

- Deposit and Payment Products (including Non-basic Deposit Products)

- Government Debentures, Stocks or Bonds

- Life Products (including Investment Life Insurance

- Products and Life Risk Insurance Products)

- Managed Investment Schemes (including IDPS)

- Retirement Savings Account Products

- Securities

- Superannuation (including Self-Managed Superannuation Funds)

- Margin Lending Facility (including Standard Margin Lending Facility)

Who is my Adviser?

Advisers are authorised by Finchley & Kent to provide financial product advice in relation to, and deal in, certain financial products and services. Finchley & Kent will be responsible for any financial services that your adviser is authorised to provide to you.

Your Adviser will be the authorised representative listed in Part Two of this FSG.

Your adviser’s profile contains important information about your adviser including details of their education and qualifications, what advice they can provide, as well as details of the advice fees you may pay and how they get paid for providing you with advice.

What other documents might I receive?

Statement of Advice

You are entitled to receive a Statement of Advice (SoA) when we first provide you with personal advice (advice that takes into account your objectives, financial situation and needs). The SoA will contain the advice, the basis on which it is given and information about fees, commissions and associations which may have influenced the provision of the advice.

If our representative provides further advice to you and your personal circumstances have not significantly changed, and that further advice is related to the advice we provided to you in a previous SoA and we do not give that further advice to you in writing, you may request a copy of the record of that further advice at any time up to seven (7) years from the date our representative gave the further advice to you. You can request the record of the advice by contacting the representative or us un writing or by telephone or by email.

Product Disclosure Statement

In the event we make a recommendation to acquire a particular financial product (other than securities), we must also provide you with a Product Disclosure Statement (PDS) containing information about the particular product, which will enable you to make an informed decision in relation to the acquisition of that product. Where we recommend a ‘Platform’ or ‘Wrap Account’ or ‘Masterfund’ you will be given a PDS for that product and, in addition, you will be given what is referred to as a ‘Short Form PDS’ which provides information about the particular managed funds we have recommended.

Portfolio Review

Internal databases are maintained detailing client’s investments that were recommended by Finchley & Kent. This does not constitute portfolio monitoring. Portfolios will be reviewed in line with your Ongoing Service Offers Agreement.

Who do you act for when you provide financial services for me?

We act for you and Finchley & Kent is responsible for the financial services provided to you.

Do any relationships or associations exist which might influence you in providing me with the financial services?

Employees, authorised representatives and directors may hold interests in products we recommend. If we recommend products that we have an interest in, we will fully disclose this to you in FSG Part 2 and/or with your SoA prior to you implementing any recommendation.

Will you provide me advice, which is suitable to my needs and financial circumstances?

Yes, and to do so we need to find out your individual objectives, financial situation and needs before we recommend any financial products or services to you.

You have the right not to divulge this information to us, if you do not wish to do so. In that case, we are required to warn you about the possible consequences of us not having your full personal information. You should read the warnings carefully.

What should I know about the risks of the financial products or strategies you recommend to me?

We will explain to you any significant risks of financial products and strategies which we recommend to you. If we do not do so, you should ask us to explain those risks to you.

Can I provide you with instructions and tell you how I wish to instruct you to buy or sell my financial products?

Yes. You may specify how you would like to give us instructions, for example by telephone, email, or other means.

What are the remunerations Finchley & Kent receive?

Finchley & Kent will charge you a fee and/or receive commissions from the issuers of the products approved by Finchley & Kent and that we recommend, and you accept.

Fees for services paid by you

Initial Consultation:

An initial consultation fee may be applicable.

Preparation of a Statement of Advice:

If you require a Statement of Advice (SoA), we may charge you a fee for its preparation. The cost will be based on the complexity of the advice and the time required in preparation of the advice. We will advise you of the cost prior to preparing the SoA. If you proceed with the recommendations of the prepared SoA and implement the advice provided, an implementation fee may be charged. These fees will be detailed in the written SoA and confirmed by us at the time of presenting the advice.

Implementation Service:

Should you proceed with our recommendations, we may charge a fee for the initial setup and implementation of all strategies within your portfolio. This will be detailed within your SoA determined on what actions need to be completed by us.

Ongoing Service:

For the provision of ongoing service and management services, we may charge a service fee based around the service level agreement suitable to your needs and portfolio. This fee may be invoiced to you personally or paid via your portfolio.

Other Costs:

Additional services provided outside those mentioned above may attract a minimum fee.

All fee for services will be agreed upon prior to providing advice or implementing any services.

Commission

Insurance products

Commissions can be received for life insurance products with the exception of life insurance implemented after 1 July 2014 for a member in default superannuation or a group life policy in a superannuation fund.

The issuers of life insurance products pay Finchley & Kent an initial commission. This commission, which can vary depending on the product and insurance company, is a maximum of 66% of your first year’s premium.

AND

The issuers of life insurance products pay Finchley & Kent an ongoing commission. This commission, which can vary depending on the product and insurance company, is a maximum of 22% of your second and subsequent year’s premium. This commission is paid each month or quarter to the licensee for as long as you hold the product.

For example: If your first year’s premium was $500 and the initial commission was 66%, we will receive $330. If your premium for the second and subsequent years was $500 and the ongoing commission was 20%, we will receive $110 per annum.

Other remuneration information

Referral payments

Finchley & Kent may receive a referral fee for each client that utilises services of any referral partner.

Each provider’s remuneration structure is different and is determined on a case by case basis. Before you enter into an arrangement with any of the above providers, Finchley & Kent will provide you with a remuneration referral disclosure document outlining any financial benefits we may receive.

The exact amounts of any fees, commissions, or other incentives received by your adviser and Finchley & Kent will be included in any Statement of Advice that we will provide to you or disclosed orally or in writing at the time we provide any further advice.

What information do you maintain in my file and can I examine my file?

We maintain a record of your personal profile, which includes details of your objectives, financial situation and needs.

We also maintain records of any recommendations made to you.

We are committed to implementing and promoting a privacy policy which will ensure the privacy and security of your personal information. A copy of our privacy policy is enclosed for your information.

If you wish to examine your file, we ask that you make a request in writing and allow up to fourteen (14) working days for the information to be forwarded.

We may charge a fee to cover the cost of verifying the application and locating, retrieving, reviewing and copying any material requested. If the information sought is extensive, we will advise of the likely cost in advance and can help you to refine your request if required.

Who can I complain to if I have a complaint about the provision of the financial services to me?

Finchley & Kent has in place Professional Indemnity Insurance that is required by the Corporations Act and which meets ASIC’s requirements and covers present and past representatives.

If you have any complaint about the service provided to you, you should take the following steps and we will seek to resolve your complaint quickly and fairly:

- Contact your adviser and discuss your complaint.

- If your complaint is not satisfactorily resolved within 5 days, please put your complaint in writing and send it to Complaints Officer, Finchley & Kent. Your complaint should be finalised within 30 days of receipt of your complaint.

Finchley & Kent is a member of the Australian Financial Complaints Authority (AFCA). If the complaint cannot be settled to your satisfaction you have the right to complain to AFCA. This service is free of charge to you and AFCA can be contacted on:

| Name | Australian Financial Complaints Authority |

| Phone | 1800 931 678 (Free Call) |

| Postal Address | GPO Box 3 Melbourne VIC 3001 |

| info@afca.org.au | |

| Website | afca.org.au |

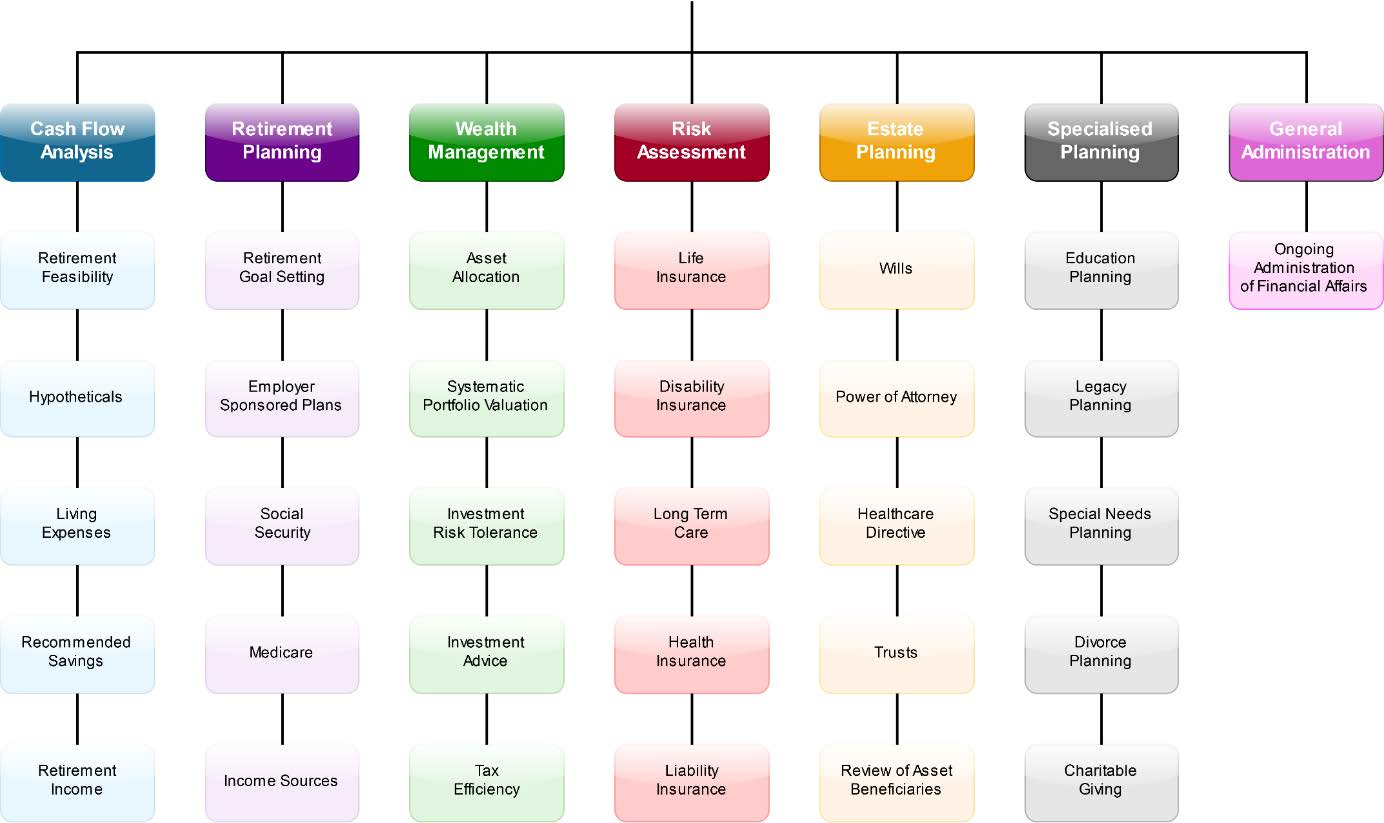

As a comprehensive financial planning firm, our services encompass each area listed below

Privacy Collection Statement

The privacy of your personal information is important to us.

Your representative will ask you many questions. Why is so much information required?

The privacy of your personal information is important to us.

We collect your personal information to enable us to provide you with the products and services that are appropriate to your needs. Under the following Australian laws we may be authorised or required to collect your personal information:

- Corporations Act 2001;

- Australian Securities and Investment Commissions Act 2001;

- Anti-Money Laundering and Counter Terrorism Financing Act 2006;

- Taxation Administration Act 1953;

- Superannuation Guarantee (Administration) Act 1992; and

- Superannuation (Unclaimed Money and lost members) Act 1999.

From time to time other acts may require or authorise us to collect your personal information.

We are required to collect sufficient information to identify a person’s needs, objectives and financial circumstances so that we can provide appropriate financial advice.

We will gather the information by asking you numerous questions about you and possibly your family. We will record this information. We endeavour to retain accurate, complete and up to date personal information about you so we will ask you to review the information from time to time.

If the information you provide to us is incomplete or inaccurate this will impact on our analysis of your requirements and may result in advice that is not appropriate to your needs and circumstances. If this does occur, you will need to make your own assessment concerning the appropriateness of our advice.

At times, we may collect personal information from someone other than yourself and you may not be aware that we collect or have collected this information.

Access and correction

You may (subject to permitted exceptions) access and update your information by contacting us. You may access the personal information we retain and request corrections. This right of access is subject to some exceptions allowed by law. We will give you reasons if we deny access though will endeavour to ensure that at all times the personal information about you that we hold is up to date and accurate. The accuracy of the personal information is dependent to a large degree on the information you provide and you should advise us if there are any errors in your personal information.

Providing personal information

We may provide personal information to:

- organisations (who are bound by strict confidentiality) to whom we outsource certain functions, such as our auditors (in these circumstances, information will only be used for our purposes);

- other professionals, such as solicitors, accountants and stockbrokers when a referral is required;

- entities based overseas (see below for details);

- third parties when required to do so by law, e.g. legislation or Court Order.

Overseas disclosure

Sometimes we need to provide personal information to or get personal information about you from persons located overseas. For example, we may outsource a function involved in the financial planning business to someone based overseas. Nevertheless, we will always disclose and collect your personal information in accordance with Privacy Principles.

Identifiers

Although in certain circumstances we are required to collect government identifiers such as tax file numbers, Medicare number or pension card number, we do not use or disclose this information other than when required or authorised by law or unless you have voluntarily consented to disclose this information to any third party.

Dealing with us anonymously or using a pseudonym

The nature of the provision of financial services does not lend itself to treating customers with anonymity. All transactions require personal information about the individual for whom the transaction is being completed.

In some instances, we may be able to provide information or a service anonymously or to you under a pseudonym, for example, enquiries about products from a potential client.

You can deal with us anonymously where it is lawful and practicable to do so.

Marketing practices

Every now and then we might let you know about news, products and services that you might be interested in, via mail, email, SMS, telephone or online. We will engage in marketing unless you tell us otherwise. You can contact us at any time to update your marketing preferences.

Sensitive information

We will not collect sensitive information about you, for example where information is provided by you for insurance or risk purposes, without your consent. Exceptions to this include where the information is required by law or for the establishment, exercise or defence of a legal claim.

Privacy complaints

If you believe your privacy has been breached or you have a privacy complaint you should write to the Privacy Officer at Finchley & Kent by email at sam@finchleyandkent.com.au.

If Finchley & Kent does not satisfactorily address your complaint you can escalate it to the AFCA, the External Dispute Resolution Scheme of which Finchley & Kent is a member.

Version: 1 Part: 2

Date: 12 August 2024

Purpose of this FSG (Part 2)

This Financial Services Guide (FSG) and its distribution is authorised by Finchley & Kent Pty Ltd (“Finchley & Kent”).

You have the right to ask us about our charges, the type of advice we will provide you, and what you can do if you have a complaint about our services.

This FSG is intended to inform you of certain basic matters relating to our relationship, prior to us providing you with a financial service. The matters covered by the FSG include, who we are, how we can be contacted, what services we are authorised to provide to you, how we (and any other relevant parties) are remunerated, details of any potential conflicts of interest, and details of our internal and external dispute resolution procedures, along with how you can access them.

It is intended that this FSG should assist you in determining whether to use any of the services described in this document.

It is Part Two of our FSG and it must be read in conjunction with Part One. Please retain both Part One and Part Two for your reference and any future dealings with Finchley & Kent.

Who will be providing the financial services to me?

Finchley & Kent conducts business through a network of financial Advisers who are appointed as Authorised Representatives under Finchley & Kent’s AFSL.

Where Finchley & Kent has appointed a corporate entity as an Authorised Representative, representatives of that company who give advice will also be authorised by Finchley & Kent.

| Licensee | Finchley & Kent Pty Ltd (“Finchley & Kent”) |

| AFSL Number | 555169 |

| ABN | 50 673 291 079 |

| Business Address | Level 63, 25 Martin Place Sydney NSW 2000 |

| Phone | 1300 770 996 |

| info@finchleyandkent.com.au | |

| Website | finchleyandkent.com.au |

Deanco Pty Ltd T/A Authentic Wealth (“Authentic Wealth”) is a Corporate Authorised Representative of Finchley & Kent and has been given permission to provide you with this FSG Part Two.

| Corporate Authorised Representative | Deanco Pty Ltd T/A Authentic Wealth (“Authentic Wealth”) |

| Corporate Authorised Representative Number | 1297625 |

| Australian Business Number | 81 657 979 443 |

| Business Address | Three International Towers, Level 24, Tower 3 300 Barangaroo Avenue Barangaroo NSW 2000 |

| Phone | +61 2 9258 1170 |

| rebecca.rousell@authenticwealth.com.au | |

| Website | https://www.authenticwealth.com.au/ |

Who is my Adviser?

Your adviser is Rebecca Rousell.

Rebecca is a Sub-Authorised Representative of Authentic Wealth.

| Authorised Representative Number | 1004186 |

| Business Address | Three International Towers, Level 24, Tower 3 300 Barangaroo Avenue Barangaroo NSW 2000 |

| Phone | +61 2 9258 1170 |

| Mobile | +61 422 954 023 |

| rebecca.rousell@authenticwealth.com.au |

Education and Qualifications

- Master of Financial Planning

- Graduate Diploma of Financial Planning

- Graduate Certificate in Financial Planning

- Advanced Diploma of financial Planning

- Diploma of Financial Services (Financial Planning)

What kinds of financial services are you authorised to provide me and what kinds of products do those services relate to?

Rebecca can offer you the following services:

- Wealth Accumulation Strategies

- Managed Investments

- Securities

- Responsible Investments

- Management

- Guidance on Budgeting

- Business Succession Planning

- Salary Packaging

- Personal Risk Insurance

- Superannuation

- Self-Managed Superannuation Funds

- Pre-Retirement Strategies

- Transition to Retirement Strategies

- Centrelink and Veteran Affairs Planning

- Aged Care Strategies

- Estate Planning Strategies

Rebecca is licensed to provide advice on, and deal in, the following financial products:

- Deposit and Payment Products (including Non-basic Deposit Products)

- Government Debentures, Stocks or Bonds

- Life Products (including Investment Life Insurance Products and Life Risk Insurance Products)

- Managed Investment Schemes (including IDPS)

- Retirement Savings Account Products

- Securities

- Superannuation (including Self-Managed Superannuation Funds)

Rebecca is not authorised to advise and deal in relation to the following products:

- Margin Lending Facility (including Standard Margin Lending Facility)

Rebecca is unable to offer you advice or services regarding the financial products or services listed below under Finchley & Kent Australian Financial Services licence. We may have referral arrangements in place for a service or financial product listed below. Please inform us if you wish to receive advice in these areas and we will be happy to refer you to a suitably qualified adviser. It is important for you to understand that we do not endorse, recommend or accept responsibility for the services, strategies and/or products provided by external referral service providers.

- Mortgage Broking and Finance

- General Insurance

- Derivatives

- Real Estate

- Taxation and Accounting

- Legal Document Drafting

- Business Coaching

Conflict of Interest – Do we have any association or relationship with a Financial Product Provider?

As your Adviser, Rebecca does not have any relationships nor receive any conflicted remuneration that may influence the advice provided to you.

Please note that Property Investment, Tax Accounting, Mortgages & Finance are not considered to be financial products and are not covered under Finchley & Kent Pty Ltd’s Australian Financial Services Licence.

Remuneration

Finchley & Kent will charge you a fee and/or receive commissions from the issuers of the products approved by Finchley & Kent and that we recommend, and you accept. Authentic Wealth is paid fees and commissions by Finchley & Kent. Authentic Wealth will then pass on these fees and commissions to Rebecca Rousell.

Fees for services paid by you

Initial Consultation:

No charge. Our initial consultation with you is an obligation-free service

Preparation of a Statement of Advice:

between $4,800 – $6,600 (including GST).

Implementation Service:

between $1,100 – $15,000 (including GST)

Ongoing Service:

FUM percentage from 0.00% up to 1.10% (including GST) depending on the complexity of the strategies and the level of service required (including GST). I note that this is applicable in a limited arrangement only and will be determined prior to services being provided.

Other Costs:

On application. Additional services provided outside those mentioned above will attract a minimum fee of $440 (including GST) per hour. Additional charges after the first hour will be at a rate of $440 (including GST) or part thereof.

All fee for services will be agreed upon prior to providing advice or implementing any services.

Commission

Insurance products

The commission is factored into the annual premium and may range as follows:

- From 0% to 66% (including GST) of the initial premium.

- From 0% to 22% per annum (including GST) of the renewal premium.

Other remuneration information

Referral payments

Finchley & Kent may receive a referral fee for each client that utilises services of any referral partner.

Each provider’s remuneration structure is different and is determined on a case by case basis. Before you enter into an arrangement with any of the above providers, we will provide you with a remuneration referral disclosure document outlining any financial benefits we may receive.

The exact amounts of any fees, commissions, or other incentives received by your adviser and Finchley & Kent will be included in any Statement of Advice that we will provide to you or disclosed orally or in writing at the time we provide any further advice.